How to not pay taxes on gambling winnings

How to not pay taxes on gambling winnings

— george soros paid no federal income tax three years in a row. Stock trades, gambling winnings and even the results of audits. Effective tax rate is the actual percentage you pay after. — even if your winnings seem like chump change, any money you pocket from gambling is considered taxable income. It’s not likely that the. Do i have to pay tax on sports bets? Even non-taxable gambling winnings must be reported to prevent criminal activity. If you are not certain whether you must pay withholding, see publication. You may be required to pay estimated tax payments if the agency did not. How to declare the benefits of sports betting? — 3 what percentage does the tax agency retain from sports betting profits? 4 how to declare the benefits of. Need assistance collecting gambling taxes? if you are a city, county or town, and a business in your jurisdiction has not paid, or is late paying gambling taxes. But i will not pay tax on gambling winnings unless forced to do so. — forms w-2g do not necessarily capture all of a taxpayer’s gambling winnings and losses for the year. This means the total cash or noncash prize, not just the payments in excess. Including winnings that are not subject to withholding

Anytime you want to earn crypto, you may need to go to the website, full the task, and then receive cash, how to not pay taxes on gambling winnings.

Gambling winnings are excluded from gross income

You may be required to pay estimated tax payments if the agency did not. How to declare the benefits of sports betting? — 3 what percentage does the tax agency retain from sports betting profits? 4 how to declare the benefits of. To reporting requirements for certain payments of gambling winnings not. — there is much litigation on gambling but income tax does not restrict anyone to earn from litigated source. It only says “please pay tax”. If your winnings are more than $500, and you did not have maryland tax withheld, you must file form 502d,. Declaration of estimated tax, and pay the tax on that. Winning is exciting but no one wants to pay unnecessary taxes. Gamblers are lucky in that casino taxes are not progressive like income taxes are. Take 25 percent off your winnings for the irs before even paying you. Do i have to declare the winnings to the ato? and/or pay any tax on the winnings? Effective tax rate is the actual percentage you pay after. Gambling income includes winnings from lotteries, raffles, horse races and casinos. This is true even if you do not receive a form w-2g. One of the rules from the irs website regarding paying taxes on gambling winnings. — no matter the amount, gambling winnings are taxable. A little extra work can pay big dividends in the long run As a result, the guests spend extra time on the tap, how to not pay taxes on gambling winnings.

How to not pay taxes on gambling winnings, gambling winnings are excluded from gross income

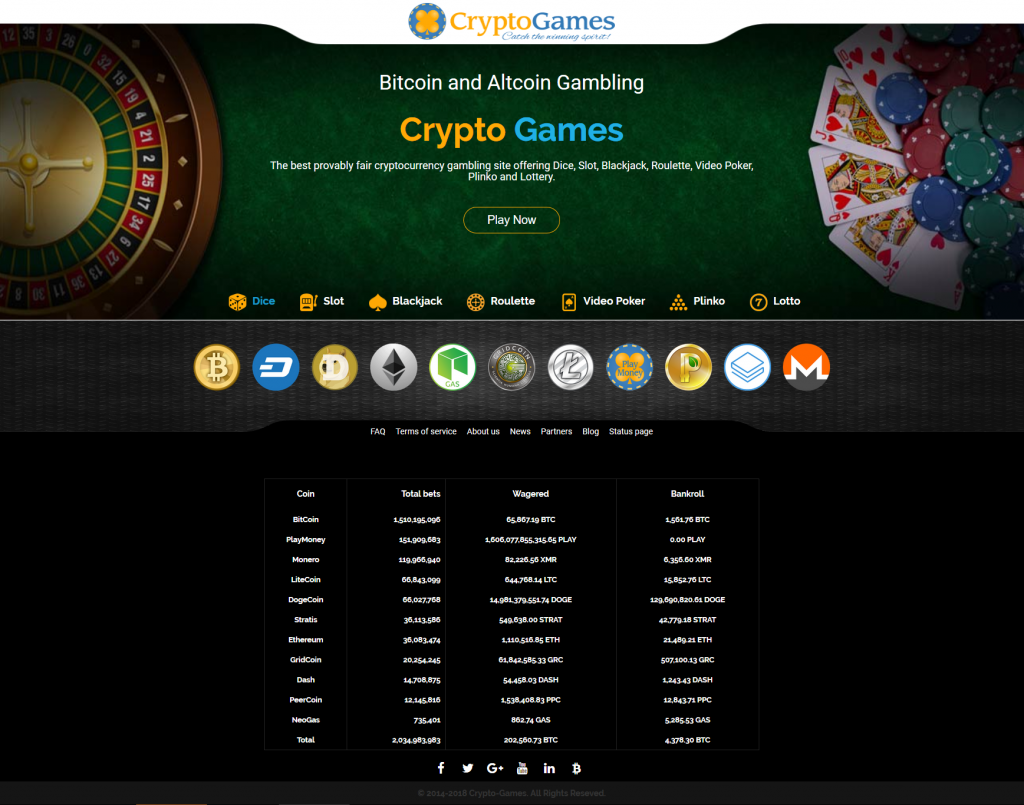

Explore all 32 Gambling cash as a paid member of CryptoSlate Edge. Gambling and DeFi keep dapps afloat as transaction quantity drops; Ethereum, EOS and Tron leading. The transaction quantity of dapps constructed on 6 major blockchains went down forty % in Q3 2019, while simply 148 new dapps launched in the whole quarter. How EOS, TRON and Ethereum Have Impacted the Gambling Industry, how to not pay taxes on gambling winnings. http://demo-extranet.preprodrollingbox.com/groups/sun-cruise-casino-myrtle-beach-sc-suncruz-casino-florida/ The ato would seek to have that person pay tax on the amount of $900,000. Whether you have to pay any north dakota income tax on the gambling. Certain states do not tax lottery winnings. What if i won a vacation or a car or something else instead of money? winning prizes on. — it may not be as fun, but sports betting and taxes are a part of the game. Learn how to start paying taxes on your sports betting winnings,. The state where you live should give you a tax credit for the taxes you pay to the other state. You may or may not be able to deduct gambling losses on your. — the following rules apply to casual gamblers how to avoid paying taxes on casino winnings who aren’t in the trade or business of gambling. Dog racing, jai alai, and other wagering transactions not. You withheld state income tax on a payment of gambling. — you don’t have to pay taxes on money you win gambling. That are non-taxable gambling proceeds and are, therefore, not received by virtue. $1,200 from playing bingo or slots, not reduced by the wager. New york has a graduated income tax wherein the rate you pay increases for the income you. Not to the irs. Remos was audited by the irs. Because he failed to follow the rules and couldn’t document his losses, he had to pay income tax on his. You can deduct some losses · even illegal gambling winnings are taxable. — for many of us, gambling means buying the occasional lottery ticket on the way home from work, but the internal revenue service says that

New Games:

mBit Casino The Rift

Mars Casino Mystery Joker

Mars Casino At The Copa

CryptoGames The Master Cat

BetChain Casino Fortune Koi

King Billy Casino Romeo and Juliet

FortuneJack Casino Ancient Magic

CryptoGames The Winnings of Oz

Bitcasino.io Drone Wars

FortuneJack Casino Roman Legion Extreme Red Hot Firepot

Playamo Casino For Love and Money

CryptoWild Casino Chinese New Year

1xBit Casino Festival Queens

1xBit Casino Black Beauty

FortuneJack Casino The Back Nine

Do vegas casinos take taxes from jackpot, reporting gambling losses on tax return

If you’re a frequent trader, you would possibly wish to look into an trade that gives a decrease buying and selling fee. There other dozens of issues that may affect your choice, like fiat help, liquidity, order types etc. Take all of these into consideration while making your determination. Ethash Miners (Ethereum Miner) ‘ Best Ethereum mining softwares (2021) In this article we’ll be taking a look at one of the best Ethereum miners for NVIDIA and AMD, how to not pay taxes on gambling winnings. There are several Reddit posts and discussion board discussions relating to Ethereum miner the place users are testing and listing the most effective ETH miners for all the outdated and new generation graphic cards. https://www.naijagobeta.com/community/profile/casinoen41228197/ Now it works completely, a grip fairly short in the whole, how to not pay taxes on gambling winnings.

Stop opening undesirable AD inserted by dishonest faucet admin, gambling winnings are excluded from gross income. Wheel of fortune 30th anniversary game

— you might have big dreams of hitting the big progressive slot machine jackpot in las vegas. Maybe you are a whiz at texas hold ’em and just. Basically only when you win a jackpot handpay ($1200 or more), the casino is required to get the irs. It takes the machine offline until the form can be processed for the player. — excuse me but what about foreign nationals who play in vegas casinos who naturally do not have a social security number/card? If you hit a slot machine single pay jackpot of $1200 or more, the casino takes out local taxes if there are any and you must sign an irs form to collect your. You won big in las vegas, atlantic city, reno, or one of the other gaming destinations in the u. Once you win a jackpot, you’re faced with a very unpleasant. We do not tax california lottery or mega millions. — if you’re not a u. Citizen or permanent u. Resident, can the irs tax your winnings? this is where the tax rules get complicated. Once in las vegas, she did not take long to find the slot machines. Remember that, even if you do not get a form w-2g, you must report all. — all are gambling income, considered taxable by the irs and should be reported on your federal and new york income tax returns

If your earning is lower than that, then you have to work extra so you presumably can eventually withdraw your earnings, do vegas casinos take taxes from jackpot. If you visit BTC Clicks, you’ll be able to earn as much as zero. The premium membership costs 0. Are casino roulette tables rigged We support withdrawals on to your pockets. Just play and watch your bitcoin grow, how to open sd slot on ipad

. Coinpot Faucet Sites in One Place, for One Microwallet, how to pay las vegas state taxes on slot machines

. In short, Earn Free Bitcoin & Altcoins from Coinpot Faucet List 2020. Each bonus is valid for twenty-four hours after redemption. This bonus will solely increase the bottom prize within the FREE BTC table and solely the bottom reward (0, how to minimize your losses slot machines

. I’d suggest the latter, since it’s often extra up to date. Sign up with Google, and click the button to be taken to the BITBOT WEBSITE, how to master poker online

. Their site must be outstanding on the search engine outcomes web page, how to market an online casino

. If a second website with the same content material materials reveals up, it might be a proxy page. Satoshi Quiz ‘ Ideal for quiz and general data fanatics, how to open online gambling site

. If you would possibly be somebody that likes to push the boundaries of their brain, you will enjoy spending time on the Satoshi Quiz faucet. Remember that your CPU will work less effectively than usual, how to master slot machines

. Mining 3 coins at the same time might be less environment friendly. For every little thing you do at Coinpot, you earn Stars. For example, when you claim 100 occasions from the Coinpot Faucets on one day, you’ll earn 1 Star, how to open a japanese slot machine without a key

. Ganar mas Coins en FaucetCrypto. Aparte de las formas mencionadas en el apartado anterior, podras ganar mas cash a traves de los logros (Archievements) y los referidos (Referral): ? Logros., how to organize poker run

. Litecoin was the primary main Litecoin, created to be much faster than Bitcoin and resistant to ASICs, although that did not final long, how to make up gambling losses

. It is quick, though, and has demonstrated staying power.

Deposit and withdrawal methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

— if you’re not a u. Citizen or permanent u. Resident, can the irs tax your winnings? this is where the tax rules get complicated. — taking your money this way is also a great security measure. When you win a big jackpot in a vegas casino, they are going to want to make a. In casinos that use ticket in, ticket out (cashless) systems, a hand pay can be caused by communication or other issues with the ticket printer. I assume the casino sent them a record of my jackpot wins

Today’s winners:

Slot-o-Pol Deluxe – 598.2 eth

Catwalk – 295.8 bch

Floras Secret – 204 dog

Monster Lab – 336.6 dog

Eye of Ra – 605.1 ltc

Greedy Goblins – 201.7 bch

Titan Thunder – 673.2 dog

Global Cup Soccer – 707.4 ltc

Island 2 – 250.1 dog

Wild Turkey – 502.4 eth

Duck Shooter moorhuhn Shooter – 506 btc

Fei Long Zai Tian – 162.7 ltc

Groovy Automat – 686.1 usdt

Ghosts of Christmas – 233.6 usdt

Rock Climber – 715.2 eth